Cruising with Confidence: Navigating the Best Insurance Companies for Your Classic Car

For classic car enthusiasts, a vintage vehicle isn’t just transportation; it’s a passion, an investment, and a tangible piece of history. Protecting this prized possession requires specialized insurance that understands the unique needs of classic car owners. Unlike standard auto insurance, classic car insurance caters to the vehicle’s age, rarity, condition, and usage. Finding the right insurance company can be a daunting task, but with careful research and consideration, you can secure the coverage that best suits your needs and allows you to enjoy your classic car with peace of mind.

Why Classic Car Insurance is Different

Before diving into the best insurance companies, it’s crucial to understand why standard auto insurance falls short for classic cars:

- Agreed Value vs. Actual Cash Value (ACV): Standard insurance typically provides ACV, which factors in depreciation. Classic car insurance, on the other hand, often offers an “agreed value” policy. This means you and the insurer agree on the car’s worth upfront, and that’s the amount you’ll receive in the event of a total loss (minus any deductible). This is critical because classic car values often appreciate, unlike modern vehicles.

- Limited Usage: Classic cars are typically driven less frequently and for specific purposes like car shows, club events, and leisurely drives. Classic car insurance policies reflect this limited usage, often offering lower premiums than standard policies.

- Specialized Repairs and Parts: Repairing a classic car requires specialized expertise and sourcing rare or custom parts. Classic car insurance companies understand this and often have networks of qualified repair shops and parts suppliers.

- Coverage Options: Classic car insurance often includes coverage options not found in standard policies, such as coverage for spare parts, car show expenses, and even appreciation in value during the policy term.

Factors to Consider When Choosing Classic Car Insurance

When evaluating classic car insurance companies, consider these key factors:

- Agreed Value Coverage: Ensure the policy offers agreed value coverage, not ACV. Understand how the agreed value is determined and whether you can negotiate it based on appraisals, documentation, and market research.

- Usage Restrictions: Be aware of any usage restrictions, such as mileage limits or limitations on driving the car to work. Choose a policy that aligns with your intended usage.

- Storage Requirements: Some insurers require the car to be stored in a secure garage or storage facility. Confirm these requirements and ensure you can meet them.

- Repair Shop Choice: Check if you have the freedom to choose your own repair shop or if the insurer requires you to use their network. For classic cars, being able to select a specialist is crucial.

- Coverage for Spare Parts and Accessories: Determine if the policy covers spare parts, tools, and accessories. This can be essential for maintaining a classic car.

- Car Show Coverage: If you frequently display your car at shows, ensure the policy covers damages or losses incurred during these events.

- Liability Coverage: Ensure the policy provides adequate liability coverage to protect you against claims for bodily injury or property damage.

- Uninsured/Underinsured Motorist Coverage: Consider adding uninsured/underinsured motorist coverage to protect yourself if you’re involved in an accident with a driver who lacks sufficient insurance.

- Deductibles: Compare deductible options and choose a deductible that you’re comfortable paying out-of-pocket in the event of a claim.

- Policy Exclusions: Carefully review the policy exclusions to understand what’s not covered. Common exclusions might include racing, off-road use, or commercial use.

- Financial Stability of the Insurer: Choose an insurer with a strong financial rating from independent agencies like A.M. Best or Standard & Poor’s. This indicates the insurer’s ability to pay claims.

- Customer Service and Claims Handling: Read online reviews and check the insurer’s reputation for customer service and claims handling. A smooth claims process is essential when dealing with a classic car.

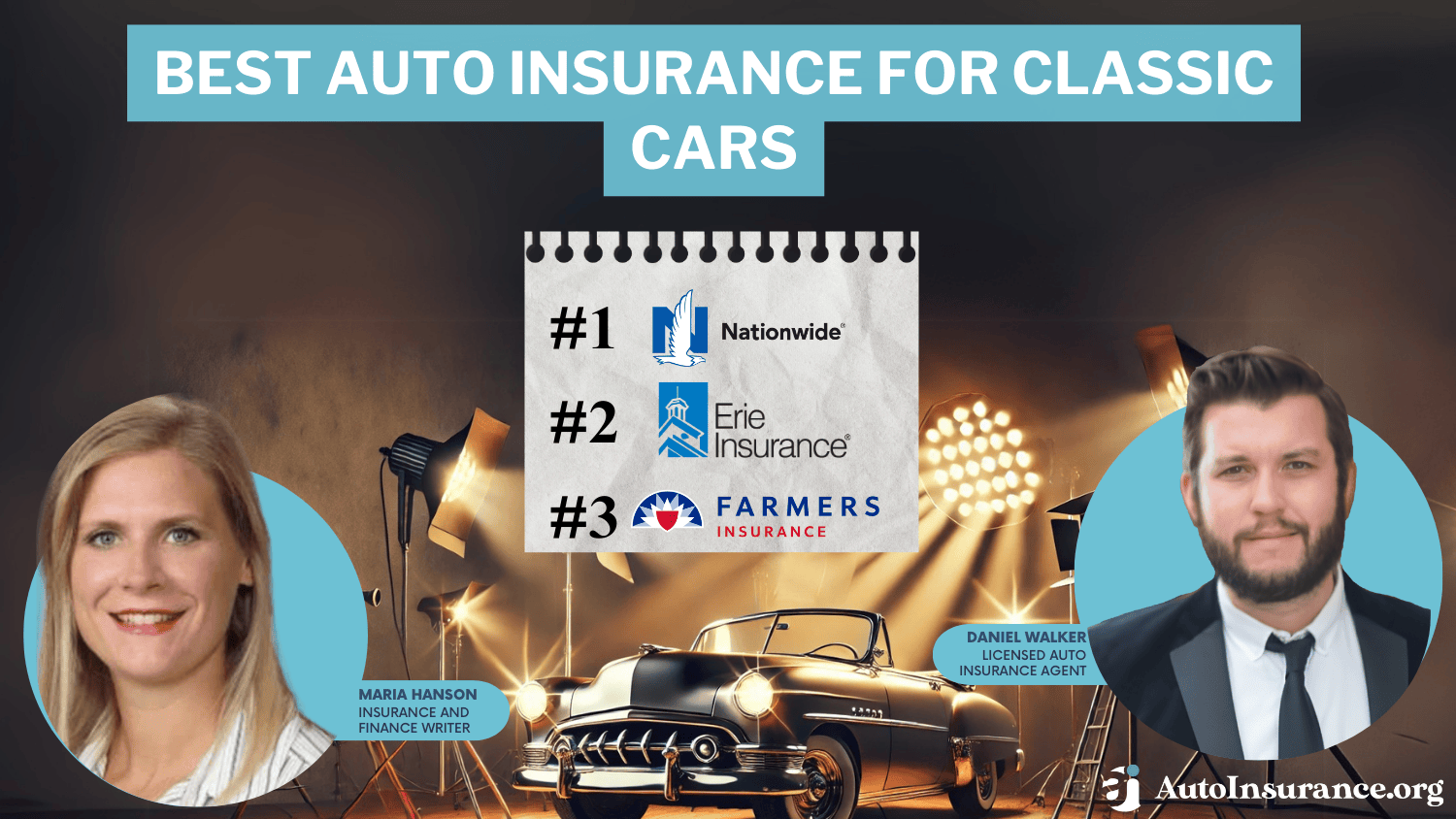

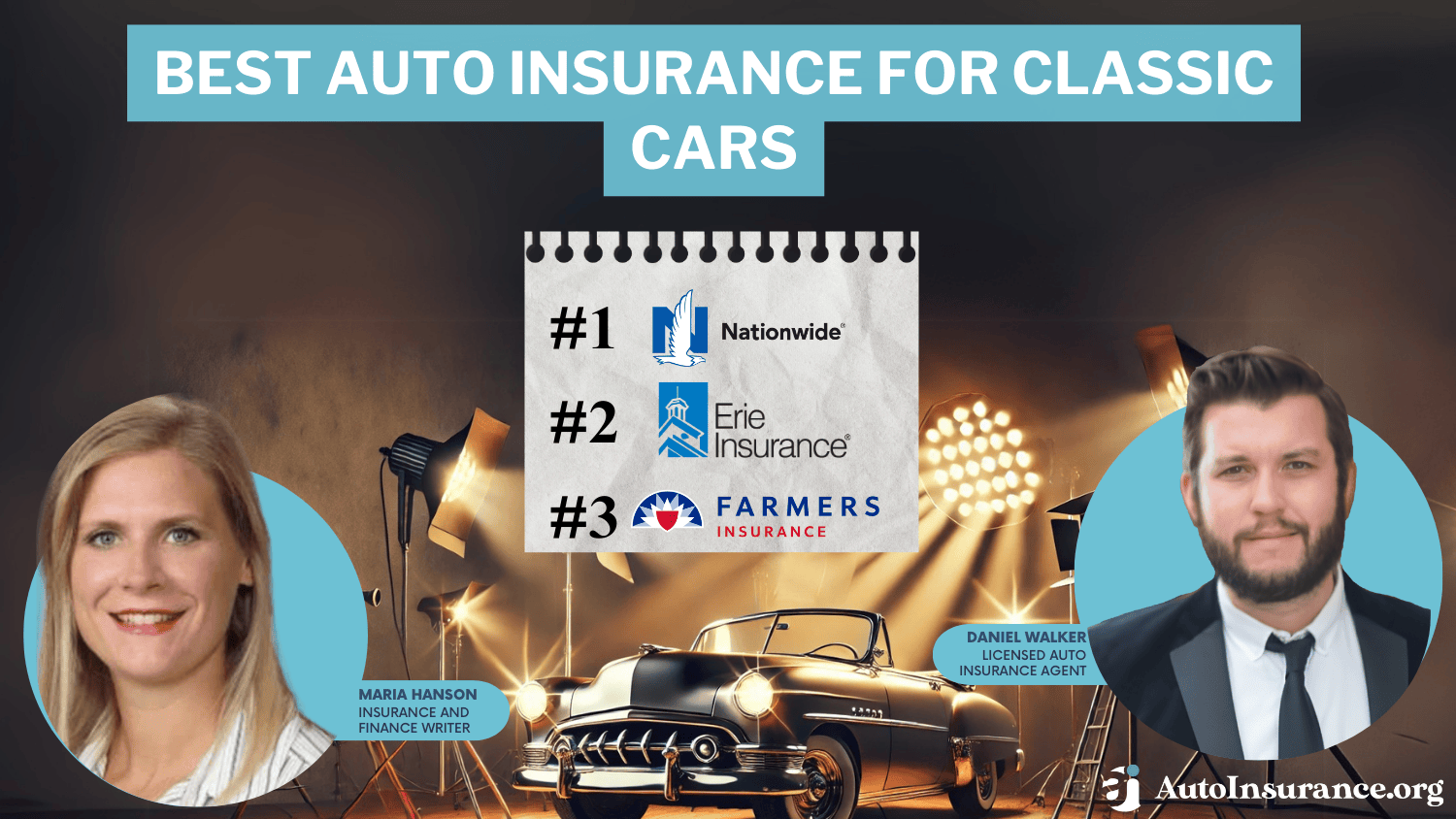

Top Classic Car Insurance Companies

While the “best” company varies depending on individual needs and circumstances, here are some of the leading and most reputable classic car insurance providers:

- Hagerty: Hagerty is arguably the most well-known and respected name in classic car insurance. They specialize exclusively in classic and collector vehicles, offering agreed value coverage, flexible usage, and specialized claims handling. Hagerty also provides resources like valuation tools, automotive events, and a community for classic car enthusiasts. They often provide coverage for spare parts and offer roadside assistance tailored to classic vehicles.

- American Collectors Insurance: American Collectors Insurance is another leading provider specializing in classic car insurance. They offer agreed value coverage, flexible usage, and coverage for spare parts and car show events. They’re known for their competitive rates and excellent customer service.

- Grundy Insurance: Grundy has been insuring classic cars for many years and has a good reputation in the industry. They offer agreed value coverage and cater to the unique needs of classic car owners. They often have flexible mileage options.

- Condon Skelly: Condon Skelly provides agreed value insurance for classic cars and offers various coverage options, including spare parts and car show coverage. They are known for their personalized service and understanding of the classic car market.

- Heacock Classic: Heacock Classic offers agreed value coverage and focuses on providing specialized insurance solutions for classic and collector vehicles. They have a good reputation for customer service and claims handling.

- State Farm: While not exclusively a classic car insurer, State Farm offers classic car insurance options through their standard auto insurance policies with adjustments to provide agreed value and limited usage options. This might be a good option for those who prefer to bundle their insurance with a larger, well-established company. However, ensure that the “classic car” options actually provide the specialized coverage you need.

- Other National Insurers: Companies like Allstate, Geico, and Progressive may offer classic car insurance through partnerships or specialized programs. It’s essential to compare their offerings carefully to ensure they provide the necessary agreed value coverage and specialized features.

Getting a Quote and Making a Decision

- Gather Information: Before getting a quote, gather information about your car, including its make, model, year, VIN, condition, restoration history, and estimated value.

- Obtain Multiple Quotes: Get quotes from several different insurance companies to compare coverage options, premiums, and deductibles.

- Read the Fine Print: Carefully review the policy documents, including the terms, conditions, exclusions, and limitations.

- Talk to an Agent: Consider speaking with an insurance agent who specializes in classic car insurance. They can provide expert advice and help you choose the right policy for your needs.

Conclusion

Protecting your classic car with the right insurance is essential for preserving your investment and enjoying your passion with confidence. By understanding the unique needs of classic cars, carefully evaluating insurance companies, and comparing coverage options, you can find the perfect policy to safeguard your prized possession for years to come. Don’t just settle for standard auto insurance; invest in the peace of mind that comes with specialized classic car coverage.