Buying vs. Leasing a Car: A Comprehensive Guide to Making the Right Choice

The decision of whether to buy or lease a car is a significant financial one, impacting your monthly budget, long-term wealth, and overall transportation needs. There’s no universally "right" answer, as the optimal choice depends heavily on your individual circumstances, financial priorities, and driving habits. This comprehensive guide will break down the pros and cons of buying and leasing, providing you with the information you need to make an informed decision.

Understanding the Basics: Buying vs. Leasing

-

Buying: When you buy a car, you take ownership of it. You either pay for the entire vehicle upfront (rare) or secure an auto loan to finance the purchase. You’re responsible for all costs associated with the car, including insurance, maintenance, repairs, and registration. Once the loan is paid off, you own the car outright and can sell it or trade it in.

-

Leasing: Leasing is essentially a long-term rental agreement. You pay a monthly fee to use the car for a specified period (typically 2-4 years). At the end of the lease term, you return the car to the leasing company. You’re generally responsible for maintenance and insurance, but your responsibilities are often more limited than when buying. You don’t own the car at any point during the lease.

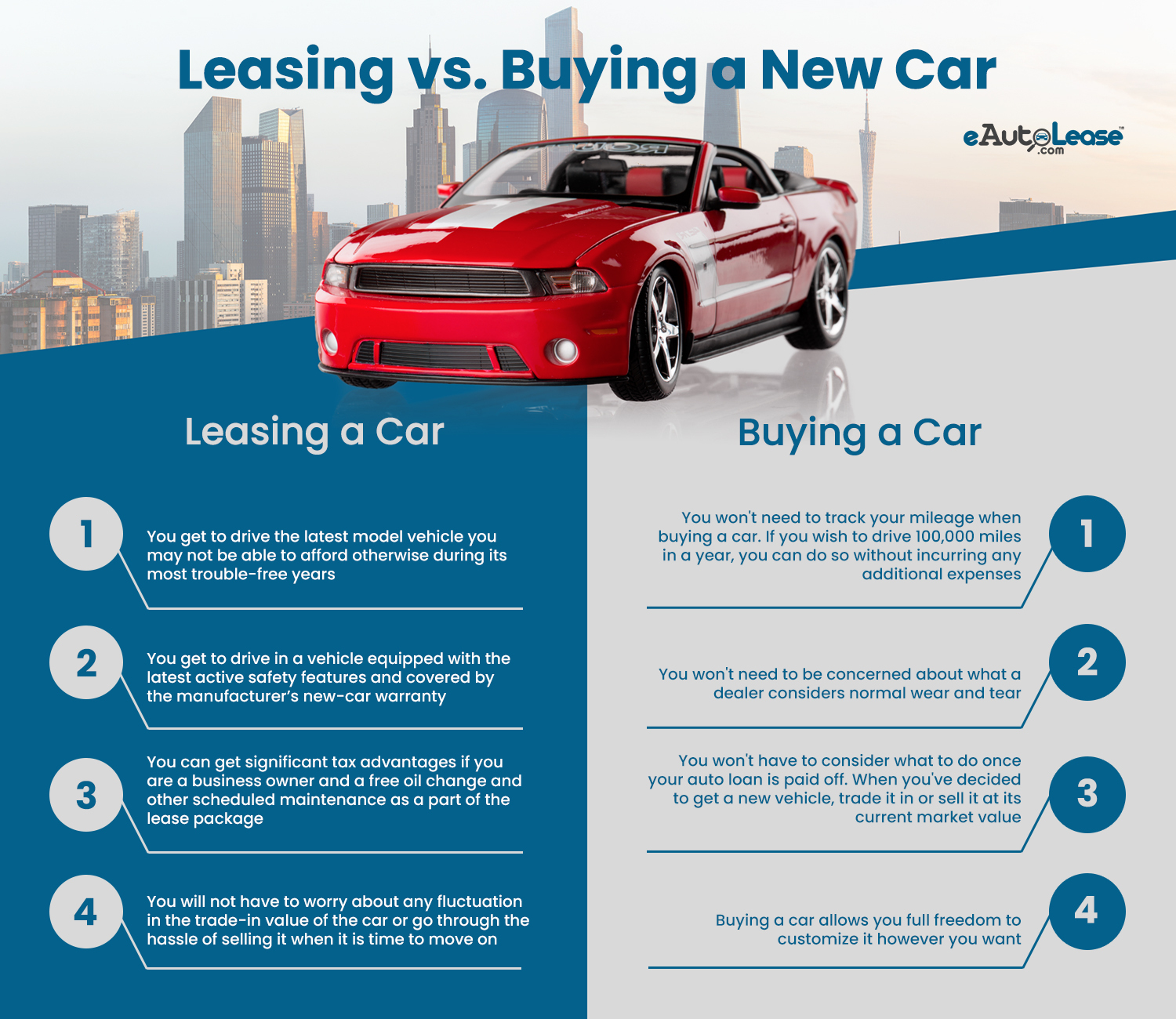

The Advantages of Buying a Car

-

Ownership and Equity: The primary advantage of buying is ownership. You build equity in the vehicle as you pay down the loan. Once the loan is paid off, you own an asset that you can sell or trade in, recouping some of your initial investment.

-

No Mileage Restrictions: Buying allows you to drive as much as you want without incurring extra charges. Leases typically have mileage limits, and exceeding those limits can result in substantial per-mile fees. If you have a long commute or frequently take road trips, buying is often the more cost-effective option.

-

Customization and Modification: As the owner, you’re free to customize or modify the car as you see fit. You can add aftermarket accessories, change the paint job, or make performance upgrades without worrying about violating a lease agreement.

-

Long-Term Cost Savings: While the initial costs of buying might seem higher, in the long run, it can be more economical. After you’ve paid off the loan, you no longer have monthly car payments. You can continue driving the car for years, saving money on transportation costs.

-

Flexibility: You have the flexibility to sell or trade in the car whenever you choose, without being tied to a lease agreement. This can be beneficial if your transportation needs change unexpectedly.

The Disadvantages of Buying a Car

-

Higher Initial Costs: Buying typically requires a larger down payment than leasing. You’ll also be responsible for sales tax, registration fees, and other upfront costs.

-

Depreciation: Cars are depreciating assets, meaning they lose value over time. The value of your car will decrease as it ages and accumulates mileage. This depreciation can significantly impact the amount you receive when you sell or trade in the car.

-

Maintenance and Repair Costs: As the car ages, it will require more maintenance and repairs. These costs can be unpredictable and can strain your budget.

-

Longer Loan Terms: To make monthly payments more affordable, buyers often opt for longer loan terms (e.g., 60 or 72 months). While this reduces the monthly payment, it also means you’ll pay more interest over the life of the loan.

-

Responsibility for Resale: When you’re ready to get a new car, you’re responsible for selling or trading in your current vehicle. This can be a time-consuming and potentially stressful process.

The Advantages of Leasing a Car

-

Lower Monthly Payments: Leasing typically results in lower monthly payments compared to buying the same car. This can free up cash flow for other expenses or investments.

-

Lower Down Payment: Leasing often requires a smaller down payment (or sometimes no down payment at all) compared to buying. This can make it easier to get into a new car.

-

Driving a Newer Car More Often: Leasing allows you to drive a new car every few years. This means you’ll always have access to the latest technology, safety features, and styling.

-

Warranty Coverage: During the lease term, the car is typically covered by the manufacturer’s warranty. This can provide peace of mind, as you won’t be responsible for major repair costs.

-

No Resale Hassle: At the end of the lease term, you simply return the car to the leasing company. You don’t have to worry about selling it or trading it in.

The Disadvantages of Leasing a Car

-

No Ownership: You never own the car when you lease. You’re essentially paying for the right to use it for a specified period.

-

Mileage Restrictions: Leases typically have mileage limits. Exceeding these limits can result in hefty per-mile charges.

-

Wear and Tear Charges: You’re responsible for maintaining the car in good condition. Excessive wear and tear (e.g., scratches, dents, stained upholstery) can result in charges at the end of the lease.

-

Early Termination Penalties: Breaking a lease early can be expensive. You may be required to pay substantial penalties.

-

Higher Long-Term Costs: In the long run, leasing can be more expensive than buying. You’re essentially paying for the depreciation of the car during the lease term, but you don’t own the asset at the end.

-

Limited Customization: You’re generally not allowed to make significant modifications to a leased car.

Factors to Consider When Choosing

-

Budget: How much can you afford to spend on monthly car payments? Consider not just the payment, but also insurance, gas, and potential maintenance costs.

-

Driving Habits: How many miles do you drive each year? If you drive a lot, buying might be the better option to avoid mileage penalties.

-

Financial Goals: Are you focused on building equity or maximizing cash flow? Buying helps build equity, while leasing provides lower monthly payments.

-

Desired Car Features: Do you want to drive a new car with the latest technology and safety features every few years? Leasing makes this easier.

-

Maintenance Preferences: Do you prefer to avoid the hassle of major repairs? Leasing can provide peace of mind with warranty coverage.

-

Length of Time You Keep a Car: How long do you typically keep a car? If you like to switch cars every few years, leasing might be a good fit. If you prefer to drive a car for many years, buying is usually more economical.

Making the Right Decision

To make the right decision, carefully evaluate your individual circumstances and prioritize your needs.

-

Calculate the Total Cost: Don’t just focus on the monthly payment. Calculate the total cost of ownership or leasing over the entire term, including interest, fees, insurance, and maintenance.

-

Negotiate the Price: Whether you’re buying or leasing, negotiate the price of the car. Research the market value and be prepared to walk away if the dealer won’t offer a fair price.

-

Read the Fine Print: Carefully read the loan or lease agreement before signing anything. Understand the terms and conditions, including mileage limits, wear and tear charges, and early termination penalties.

-

Consider Your Alternatives: Explore all your transportation options, including public transportation, ride-sharing services, and carpooling.

In conclusion:

Choosing between buying and leasing a car is a personal decision. By carefully considering the pros and cons of each option, evaluating your financial situation, and understanding your driving needs, you can make an informed decision that aligns with your goals and priorities. There is no universal "best" option, but with careful planning and research, you can choose the path that’s right for you.