How to Get Cheap Car Insurance in Your State: A Comprehensive Guide

Car insurance is a necessary expense for any driver, but it doesn’t have to break the bank. With a little research and some strategic planning, you can find affordable coverage that fits your needs. This guide provides a detailed roadmap to getting cheap car insurance in your state.

1. Understand the Basics of Car Insurance

Before diving into cost-saving strategies, it’s essential to understand the fundamental components of car insurance:

- Liability Coverage: This protects you if you’re at fault in an accident and cause injury or property damage to others. It’s usually required by law.

- Collision Coverage: This covers damage to your vehicle from collisions with other vehicles or objects, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, weather, or animal strikes.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who has no insurance or insufficient coverage to pay for your damages.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of who is at fault. (Not available in all states)

2. Shop Around and Compare Quotes

The most effective way to find cheap car insurance is to shop around and compare quotes from multiple insurers. Don’t settle for the first quote you receive. Each company has its own unique rating system, and prices can vary significantly.

- Online Comparison Tools: Websites like QuoteWizard, The Zebra, and Insurify allow you to enter your information once and receive quotes from multiple insurers.

- Direct Quotes: Visit the websites of major insurance companies (e.g., State Farm, GEICO, Progressive, Allstate) and request quotes directly.

- Independent Agents: Work with an independent insurance agent who can gather quotes from multiple companies on your behalf. They can provide personalized advice and help you understand the different coverage options.

3. Factors That Affect Car Insurance Rates

Insurers consider various factors when determining your car insurance rates. Understanding these factors can help you identify areas where you can potentially save money.

- Driving Record: A clean driving record with no accidents or traffic violations is the most significant factor in getting cheap car insurance.

- Age: Younger drivers (especially those under 25) typically pay higher rates due to their inexperience. Rates tend to decrease as you age.

- Gender: Statistically, young male drivers are involved in more accidents than young female drivers, so they often pay higher rates.

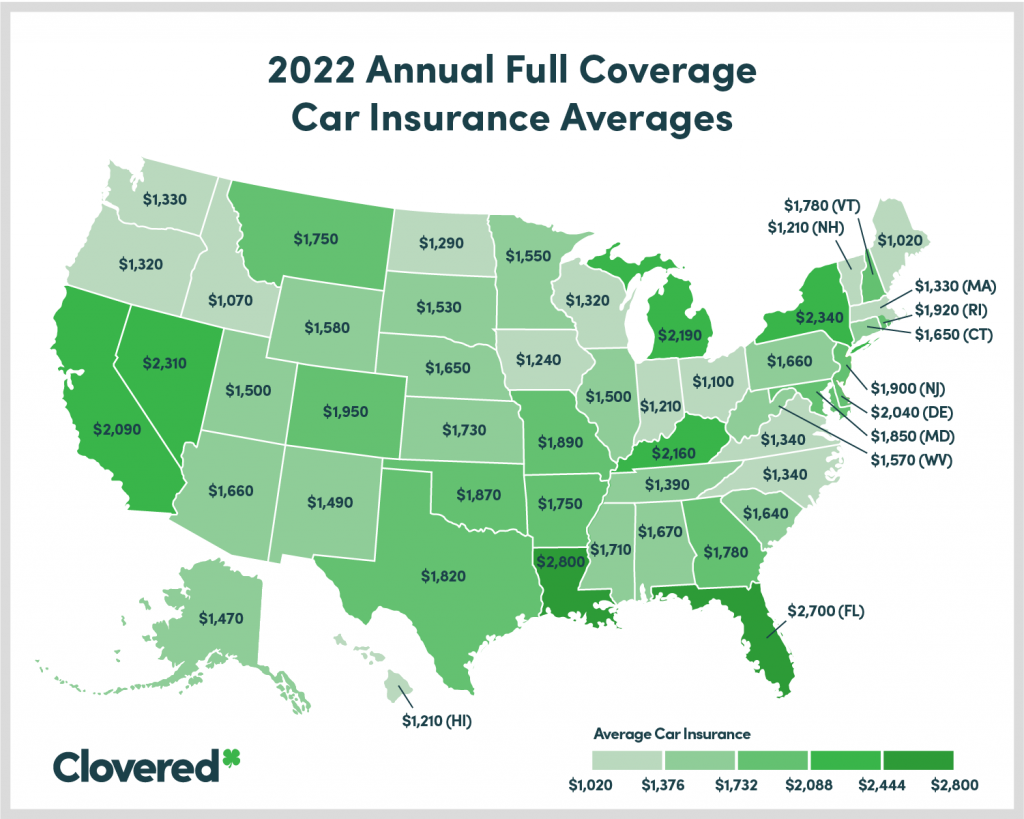

- Location: Urban areas with higher traffic density and crime rates tend to have higher insurance rates than rural areas.

- Vehicle Type: The make, model, and year of your car can impact your insurance rates. Expensive cars, sports cars, and vehicles with high theft rates generally cost more to insure.

- Credit Score: In most states, insurers can use your credit score to determine your rates. A higher credit score typically results in lower rates.

- Coverage Levels: The amount of coverage you choose (e.g., liability limits, deductibles) directly affects your premium.

- Annual Mileage: The more you drive, the higher your risk of being involved in an accident, so higher mileage may lead to higher rates.

4. Strategies to Lower Your Car Insurance Premiums

Now, let’s explore specific strategies you can use to lower your car insurance premiums:

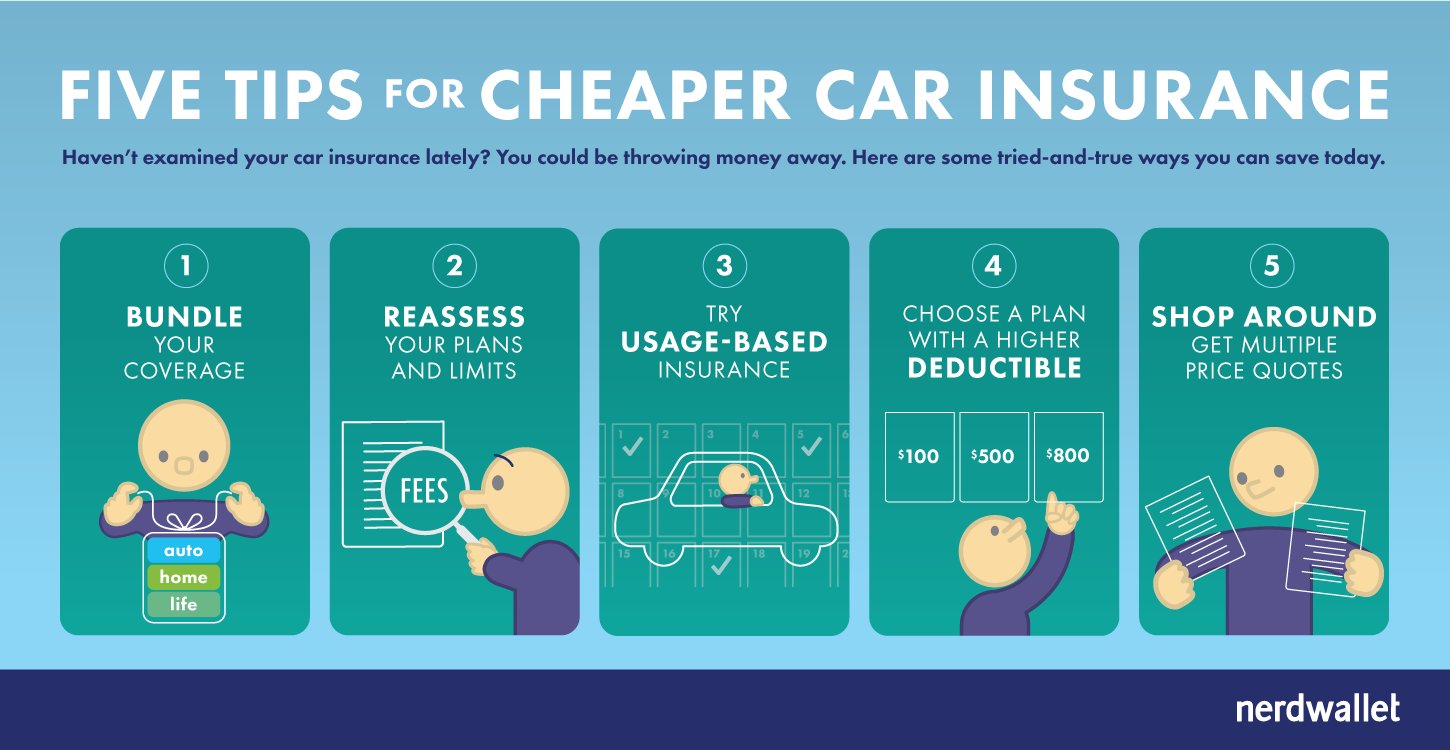

- Increase Your Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Raising your deductible (e.g., from $500 to $1,000) can significantly lower your premium. Just make sure you can afford to pay the higher deductible if you need to file a claim.

- Reduce Coverage on Older Cars: If you have an older car with low market value, it may not be worth carrying collision and comprehensive coverage. Consider dropping these coverages to save money.

- Take Advantage of Discounts: Insurers offer a variety of discounts to attract and retain customers. Be sure to ask about all available discounts, such as:

- Safe Driver Discount: For maintaining a clean driving record.

- Good Student Discount: For students with good grades.

- Multi-Car Discount: For insuring multiple vehicles with the same company.

- Homeowner Discount: For bundling your car insurance with your homeowners or renters insurance.

- Military Discount: For active duty military personnel and veterans.

- Affiliation Discount: For members of certain organizations or alumni associations.

- Payment Discount: For paying your premium in full or setting up automatic payments.

- Anti-Theft Device Discount: For installing anti-theft devices in your car.

- Improve Your Credit Score: If you live in a state where insurers use credit scores, improving your credit score can lead to lower rates. Pay your bills on time, reduce your debt, and avoid opening too many new credit accounts.

- Bundle Your Insurance: Many insurers offer discounts when you bundle your car insurance with other types of insurance, such as homeowners, renters, or life insurance.

- Consider Usage-Based Insurance (UBI): UBI programs, also known as "pay-as-you-drive" or "telematics" insurance, track your driving habits (e.g., speed, braking, mileage) using a mobile app or device installed in your car. If you’re a safe driver, you can earn significant discounts.

- Maintain Continuous Coverage: Gaps in your insurance coverage can raise your rates. Even if you don’t own a car, consider maintaining a non-owner car insurance policy to demonstrate continuous coverage.

- Avoid Filing Small Claims: Filing too many small claims can increase your rates. Consider paying for minor repairs out of pocket to avoid filing a claim.

- Shop Around Regularly: Car insurance rates can change over time, so it’s a good idea to shop around and compare quotes at least once a year or when your policy is up for renewal.

- Choose Your Car Wisely: Before buying a new car, research the insurance costs for different makes and models. Some cars are simply more expensive to insure than others.

- Drive Safely: The most important thing you can do to get cheap car insurance is to drive safely and avoid accidents and traffic violations.

5. State-Specific Considerations

Car insurance regulations and requirements vary by state. Be sure to research the specific requirements in your state to ensure you have adequate coverage.

- Minimum Coverage Requirements: Each state has minimum liability coverage requirements that you must meet.

- No-Fault vs. Fault-Based States: In no-fault states, your own insurance company pays for your medical expenses and lost wages, regardless of who is at fault. In fault-based states, the at-fault driver’s insurance company pays for these expenses.

- Credit Score Usage: Some states prohibit insurers from using credit scores to determine car insurance rates.

- Available Discounts: Some discounts may be specific to certain states.

Conclusion

Getting cheap car insurance requires a proactive approach. By understanding the factors that affect your rates, shopping around for the best deals, and taking advantage of available discounts, you can find affordable coverage that meets your needs and protects you on the road. Remember to review your policy regularly and make adjustments as your circumstances change.