The Luxury Car Conundrum: Should You Lease or Buy Your Dream Ride?

The allure of a luxury car is undeniable. The sleek design, advanced technology, premium materials, and exhilarating performance all combine to create an experience that transcends mere transportation. However, the path to acquiring such a vehicle presents a significant decision: Should you lease or buy?

This isn’t a simple question, as the best choice depends heavily on individual circumstances, financial goals, and lifestyle preferences. This article dives deep into the pros and cons of each option, providing the insights you need to make an informed decision that aligns with your needs and desires.

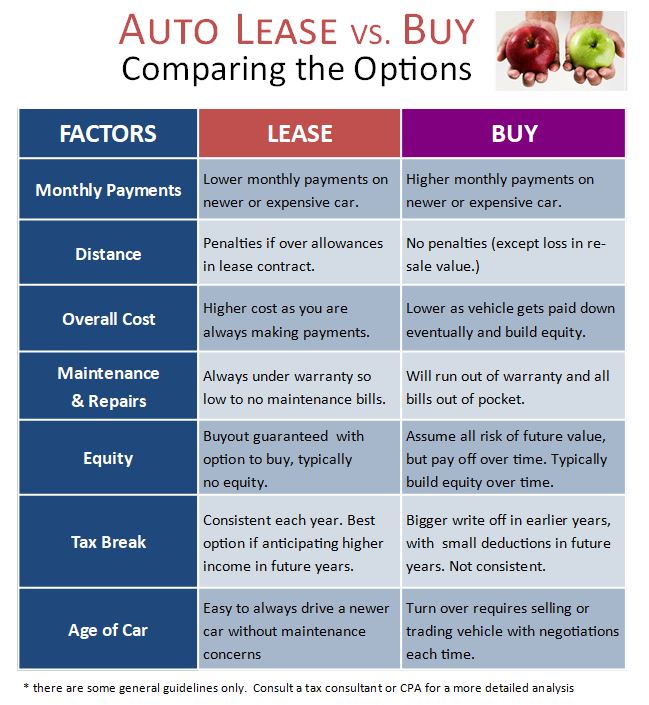

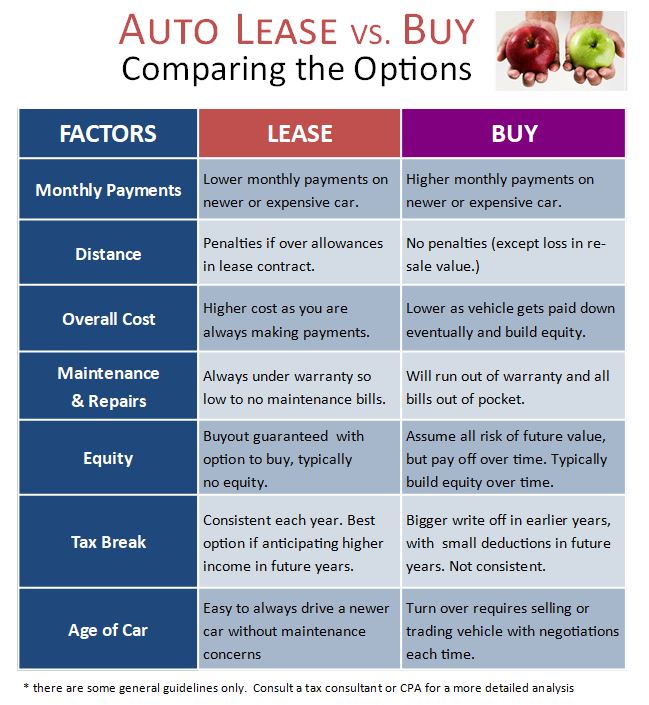

Understanding the Basics: Leasing vs. Buying

Before we delve into the specifics, let’s establish a clear understanding of what leasing and buying entail:

-

Leasing: Essentially, leasing is like renting a car for a fixed period (typically 2-3 years). You make monthly payments for the use of the vehicle, but you don’t own it. At the end of the lease term, you return the car to the dealership.

-

Buying: Buying a car means you own it outright (or will own it once you’ve paid off the loan). You make monthly payments to a lender until the loan is satisfied, at which point you receive the title and have full ownership.

The Case for Leasing a Luxury Car

Leasing often presents an attractive proposition, especially for luxury vehicles, due to the following advantages:

-

Lower Monthly Payments: Leasing typically results in lower monthly payments compared to buying the same car. This is because you’re only paying for the depreciation of the vehicle during the lease term, rather than the entire purchase price.

-

Drive a Newer Car More Often: Leasing allows you to drive a new car every few years. This means you can always have the latest technology, safety features, and design updates. For those who enjoy staying on the cutting edge, leasing offers a convenient way to do so.

-

Reduced Maintenance Costs: Most leases cover the vehicle’s warranty period, which means you’re less likely to incur significant maintenance costs during the lease term. Routine maintenance like oil changes and tire rotations may still be your responsibility, but major repairs are usually covered.

-

Tax Advantages for Businesses: If you use the luxury car for business purposes, you may be able to deduct a portion of your lease payments as a business expense. This can result in significant tax savings.

-

Easier Trade-In Process: At the end of the lease, you simply return the car to the dealership. You don’t have to worry about selling it or dealing with the trade-in process, which can be time-consuming and potentially lead to a lower value than expected.

The Case Against Leasing a Luxury Car

While leasing offers several benefits, it’s not without its drawbacks:

-

No Ownership: The most significant disadvantage of leasing is that you never own the car. At the end of the lease, you have nothing to show for your payments except the use of the vehicle for a limited time.

-

Mileage Restrictions: Leases typically come with mileage restrictions, usually around 10,000-15,000 miles per year. Exceeding these limits can result in hefty per-mile charges at the end of the lease.

-

Excess Wear and Tear Charges: You’re responsible for maintaining the car in good condition during the lease term. Excessive wear and tear, such as dents, scratches, or interior damage, can result in additional charges when you return the vehicle.

-

Early Termination Penalties: Breaking a lease early can be very expensive. You’ll likely have to pay a substantial penalty, which could include the remaining lease payments, plus other fees.

-

Higher Long-Term Costs: Over the long run, leasing can be more expensive than buying. This is because you’re essentially paying for the depreciation of a series of vehicles, rather than building equity in one.

The Case for Buying a Luxury Car

Buying a luxury car offers a different set of advantages:

-

Ownership: The most obvious benefit of buying is that you own the car. You can customize it, drive it as much as you want, and eventually sell it or trade it in.

-

No Mileage Restrictions: You can drive as many miles as you want without incurring additional charges. This is particularly important for those who travel frequently or have long commutes.

-

Building Equity: As you make loan payments, you build equity in the car. Once the loan is paid off, you own the vehicle outright and can sell it for a profit or keep it for the long term.

-

Customization: When you own a car, you can customize it to your liking. You can add aftermarket accessories, modify the engine, or change the appearance without worrying about violating lease terms.

-

Potential for Long-Term Savings: If you keep the car for many years after the loan is paid off, you can save money on transportation costs. You won’t have to make monthly payments, and you can avoid the depreciation costs associated with buying a new car every few years.

The Case Against Buying a Luxury Car

Buying also has its drawbacks:

-

Higher Monthly Payments: Buying typically results in higher monthly payments compared to leasing the same car. This is because you’re paying for the entire purchase price of the vehicle.

-

Depreciation: Luxury cars can depreciate quickly, especially in the first few years. This means that the value of your car may decrease significantly over time, which can affect your ability to sell it for a good price.

-

Maintenance Costs: As the car ages, you’ll likely incur higher maintenance costs. Repairs can be expensive, especially for luxury vehicles with advanced technology and specialized parts.

-

Trade-In Hassle: Selling or trading in a car can be a time-consuming and stressful process. You’ll have to negotiate with potential buyers or dealerships, and you may not get as much money as you expect.

-

Larger Initial Investment: Buying a car usually requires a larger initial investment, including a down payment, taxes, and fees.

Factors to Consider When Making Your Decision

When deciding whether to lease or buy a luxury car, consider the following factors:

- Budget: How much can you afford to spend each month? Leasing typically offers lower monthly payments, but buying can be more cost-effective in the long run.

- Driving Habits: How many miles do you drive each year? If you drive a lot, buying may be a better option to avoid mileage restrictions.

- Lifestyle: Do you enjoy driving a new car every few years? If so, leasing may be a good fit.

- Financial Goals: Are you focused on building equity? If so, buying is the way to go.

- Tax Situation: Can you take advantage of any tax deductions for business use? If so, leasing may be more advantageous.

- Maintenance Preferences: Do you prefer to avoid major repairs? Leasing can provide peace of mind with warranty coverage.

A Final Word

There is no single "right" answer to the lease vs. buy question. The best choice depends on your individual circumstances and preferences. By carefully considering the pros and cons of each option and evaluating your own needs, you can make an informed decision that will help you enjoy the luxury car of your dreams without breaking the bank.

Before making a final decision, it’s always a good idea to get quotes for both leasing and buying the specific car you’re interested in. Compare the total cost of ownership over the expected term and consider all the factors discussed above. With careful planning and research, you can find the best way to get behind the wheel of your dream luxury car.