The True Price of Your Ride: Calculating the Total Cost of Car Ownership

Buying a car is often one of the biggest financial decisions a person makes. However, the sticker price is just the tip of the iceberg. The total cost of car ownership (TCO) encompasses a range of expenses that can significantly impact your budget over the vehicle’s lifespan. Understanding and calculating these costs is crucial for making informed decisions, choosing the right vehicle, and managing your finances effectively.

Why Calculate the Total Cost of Car Ownership?

- Budgeting: Knowing the true cost of a car allows you to budget accurately and avoid financial surprises.

- Comparison Shopping: TCO enables you to compare different vehicles and identify the most cost-effective option, even if the initial purchase price is higher.

- Negotiation: Armed with TCO information, you can negotiate a better price, financing terms, or insurance rates.

- Financial Planning: TCO helps you plan for long-term expenses, such as maintenance and repairs, and avoid unexpected financial burdens.

- Decision Making: It provides a holistic view of car ownership, enabling you to determine if owning a car is the best option for your needs and financial situation.

Key Components of the Total Cost of Car Ownership

To calculate the total cost of car ownership accurately, you need to consider the following expenses:

-

Purchase Price/Depreciation:

-

Purchase Price: This is the initial cost of the vehicle, including taxes, fees, and any optional features.

-

Depreciation: This is the decline in the car’s value over time. Depreciation is often the most significant cost of car ownership, especially in the first few years. Factors that affect depreciation include:

- Vehicle make and model

- Mileage

- Condition

- Market demand

- Vehicle age

- Repair history

-

Calculation: To estimate depreciation, you can use online tools, consult Kelley Blue Book, or NADA guides. Subtract the estimated resale value of the car at the end of your ownership period from the purchase price.

-

-

Fuel Costs:

-

Fuel Efficiency: Fuel efficiency is measured in miles per gallon (MPG). Higher MPG means lower fuel costs.

-

Driving Habits: Your driving habits, such as speeding, aggressive acceleration, and frequent braking, can significantly impact fuel efficiency.

-

Fuel Prices: Fuel prices fluctuate based on market conditions, location, and grade of fuel.

-

Calculation: To estimate annual fuel costs:

- Determine your average annual mileage.

- Find the vehicle’s MPG (check the EPA fuel economy label or online resources).

- Divide your annual mileage by the MPG to get the number of gallons you’ll use per year.

- Multiply the number of gallons by the average fuel price in your area.

-

-

Insurance:

- Coverage: The type and amount of coverage you choose will affect your insurance premiums. Common types of coverage include:

- Liability: Covers damages or injuries you cause to others in an accident.

- Collision: Covers damage to your vehicle from a collision, regardless of fault.

- Comprehensive: Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist: Covers your damages if you’re hit by a driver with insufficient insurance.

- Factors Affecting Premiums: Insurance premiums are influenced by factors such as:

- Driving record

- Age

- Gender

- Location

- Vehicle type

- Credit score

- Calculation: Get quotes from multiple insurance companies to compare rates and coverage options. Multiply the monthly premium by 12 to estimate your annual insurance costs.

- Coverage: The type and amount of coverage you choose will affect your insurance premiums. Common types of coverage include:

-

Maintenance and Repairs:

- Routine Maintenance: Regular maintenance, such as oil changes, tire rotations, and filter replacements, is essential for keeping your car running smoothly and preventing costly repairs.

- Repairs: Unexpected repairs can be a significant expense. The frequency and cost of repairs will vary depending on the vehicle’s make, model, age, and condition.

- Calculation: Consult the vehicle’s maintenance schedule to estimate the cost of routine maintenance. Research common repair issues for the vehicle and set aside a budget for potential repairs.

-

Tires:

- Tire Life: Tires typically last between 25,000 and 50,000 miles, depending on the tire type, driving habits, and road conditions.

- Tire Costs: Tire prices vary depending on the brand, size, and type of tire.

- Calculation: Estimate how often you’ll need to replace your tires based on your annual mileage and tire life. Divide the cost of a new set of tires by the number of years you expect them to last to estimate your annual tire costs.

-

Registration and Taxes:

- Registration Fees: These are annual fees charged by your state or local government to register your vehicle.

- Personal Property Taxes: Some states charge personal property taxes on vehicles.

- Calculation: Check with your local Department of Motor Vehicles (DMV) or tax assessor’s office to determine the registration fees and personal property taxes for your vehicle.

-

Financing Costs (if applicable):

- Interest: If you finance your car, you’ll pay interest on the loan.

- Loan Term: The length of the loan term will affect the total amount of interest you pay.

- Calculation: Use a loan calculator to estimate the total interest you’ll pay over the life of the loan. Add the interest to the purchase price to determine the total cost of financing.

-

Parking and Tolls:

- Parking Fees: If you live or work in an urban area, you may have to pay for parking.

- Tolls: Toll roads and bridges can add to your transportation costs.

- Calculation: Estimate your annual parking and toll expenses based on your typical driving routes and parking habits.

Calculating the Total Cost of Car Ownership: A Step-by-Step Guide

- Gather Information: Collect information on the vehicle’s purchase price, fuel efficiency, insurance rates, maintenance schedule, and other relevant costs.

- Estimate Annual Mileage: Determine how many miles you expect to drive each year.

- Calculate Individual Expenses: Use the formulas and guidelines above to estimate the annual cost of each expense category.

- Add Up the Expenses: Sum up all the individual expenses to arrive at the total annual cost of car ownership.

- Consider the Ownership Period: Multiply the total annual cost by the number of years you plan to own the vehicle to estimate the total cost of ownership over the vehicle’s lifespan.

Tips for Reducing the Total Cost of Car Ownership

- Choose a Fuel-Efficient Vehicle: Opt for a vehicle with high MPG to reduce fuel costs.

- Maintain Your Car Regularly: Regular maintenance can prevent costly repairs and extend the life of your vehicle.

- Shop Around for Insurance: Get quotes from multiple insurance companies to find the best rates.

- Drive Responsibly: Avoid speeding, aggressive acceleration, and frequent braking to improve fuel efficiency and reduce wear and tear on your vehicle.

- Consider Buying a Used Car: Used cars typically have lower purchase prices and depreciate less rapidly than new cars.

- Pay Attention to Tire Pressure: Properly inflated tires improve fuel efficiency and extend tire life.

- Avoid Unnecessary Driving: Walk, bike, or use public transportation whenever possible to reduce your mileage and fuel consumption.

Tools and Resources

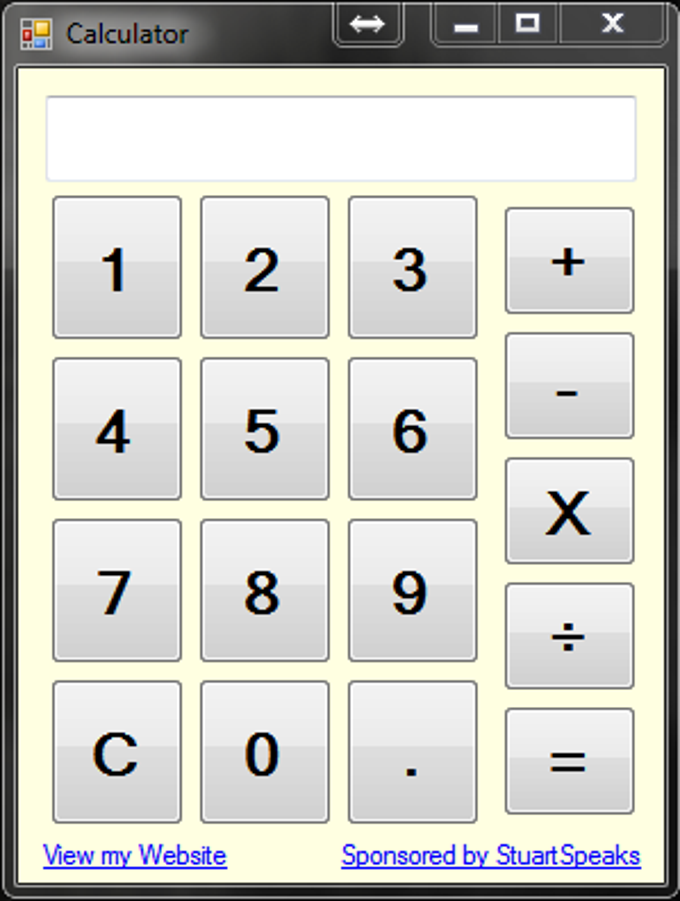

- Online TCO Calculators: Many websites offer TCO calculators that can help you estimate the total cost of car ownership.

- EPA Fuel Economy Website: Provides fuel efficiency ratings for vehicles.

- Kelley Blue Book (KBB) and NADA Guides: Offer vehicle pricing and valuation information.

- Insurance Comparison Websites: Allow you to compare insurance rates from multiple companies.

Conclusion

Calculating the total cost of car ownership is essential for making informed financial decisions and managing your transportation expenses effectively. By considering all the relevant costs, you can choose the right vehicle, negotiate a better price, and plan for long-term expenses. This knowledge empowers you to make confident choices and enjoy the benefits of car ownership without financial strain.